Thinking about launching a startup in the Middle East? You're looking at one of the world's most dynamic growth markets. The region is buzzing with ambitious government backing, a large and digitally-savvy consumer base, and investors ready to fund big ideas.

But it’s a unique playing field. Success here requires understanding the local context—a blend of wide-open opportunities and hyper-speed digitization you won't find in mature ecosystems. This guide is your playbook for navigating it.

The Middle East isn't just "emerging" anymore; it's a core part of the global innovation scene. As governments across the region push to diversify their economies beyond oil, they've made entrepreneurship a top priority.

This strategic shift has opened the floodgates for venture capital, sparked major policy reforms, and led to the build-out of world-class digital infrastructure. It's an incredibly fertile ground for building something new. This guide cuts through the hype and gives you a practical, actionable roadmap. We’ll get into the nitty-gritty of what it takes to build a successful middle east startup—from picking the right city to locking in your first round of funding.

Our goal is simple: to give you the on-the-ground insights you need to make smarter decisions, faster. We'll lay out clear frameworks and advice you can use immediately.

Here's what we'll cover:

This isn't just a list of facts. It's a playbook designed to turn insight into action. By the end, you'll have a clear picture of the opportunities, a realistic view of the challenges, and a concrete set of next steps for your startup.

Deciding where to set up shop is one of the first, most critical decisions you'll make. Your home base isn't just an address; it's your launchpad. The right city connects you to the right talent, capital, and customers. The wrong one can create friction that grinds you down before you even get going.

This isn’t about chasing trends. It’s a strategic choice that must align with your business model, your target customer, and your five-year vision. Every hub in the MENA region has its own distinct mix of pros and cons.

Dubai is the region's undisputed international hub, a magnet for global talent and capital. It's the default choice for startups with global ambitions from day one.

The city’s strength lies in its world-class infrastructure, founder-friendly regulations, and powerful free zones. These zones, like the Dubai International Financial Centre (DIFC), allow for 100% foreign ownership and operate under familiar international legal frameworks. This creates a stable, predictable environment for a Middle East startup, which is especially appealing for FinTech and SaaS companies building for a global audience.

Just an hour away, Abu Dhabi is carving out a niche in deep tech, sustainability, and high-value industries. The emirate is leveraging its sovereign wealth to build a powerful support system for startups in specific, strategic sectors.

Initiatives like Hub71 offer significant perks, including equity-free subsidies and direct connections to major corporate and government partners. If you're working on something complex in HealthTech, AgriTech, or Climate Tech, Abu Dhabi offers a uniquely supportive ecosystem designed to bring big ideas to market.

Riyadh is the region's breakout star. The growth is explosive, fueled by Saudi Arabia’s ambitious Vision 2030 plan. The Kingdom is the single largest market in the GCC, and for any B2C or B2B startup that can tap into its young, hyper-connected population, the potential is enormous.

The Saudi government is investing billions in its tech infrastructure. While the ecosystem is still maturing compared to Dubai's, the sheer scale of the domestic opportunity is something no other city can offer. If the Saudi market is critical to your success, setting up in Riyadh is non-negotiable.

Next Action: Map your ideal customer profile and core business needs against what each city truly offers. A B2B SaaS company might thrive in Dubai's international ecosystem, while a direct-to-consumer app could find faster traction in Riyadh's massive domestic market. Ask your team: "Where do our first 100 customers live?"

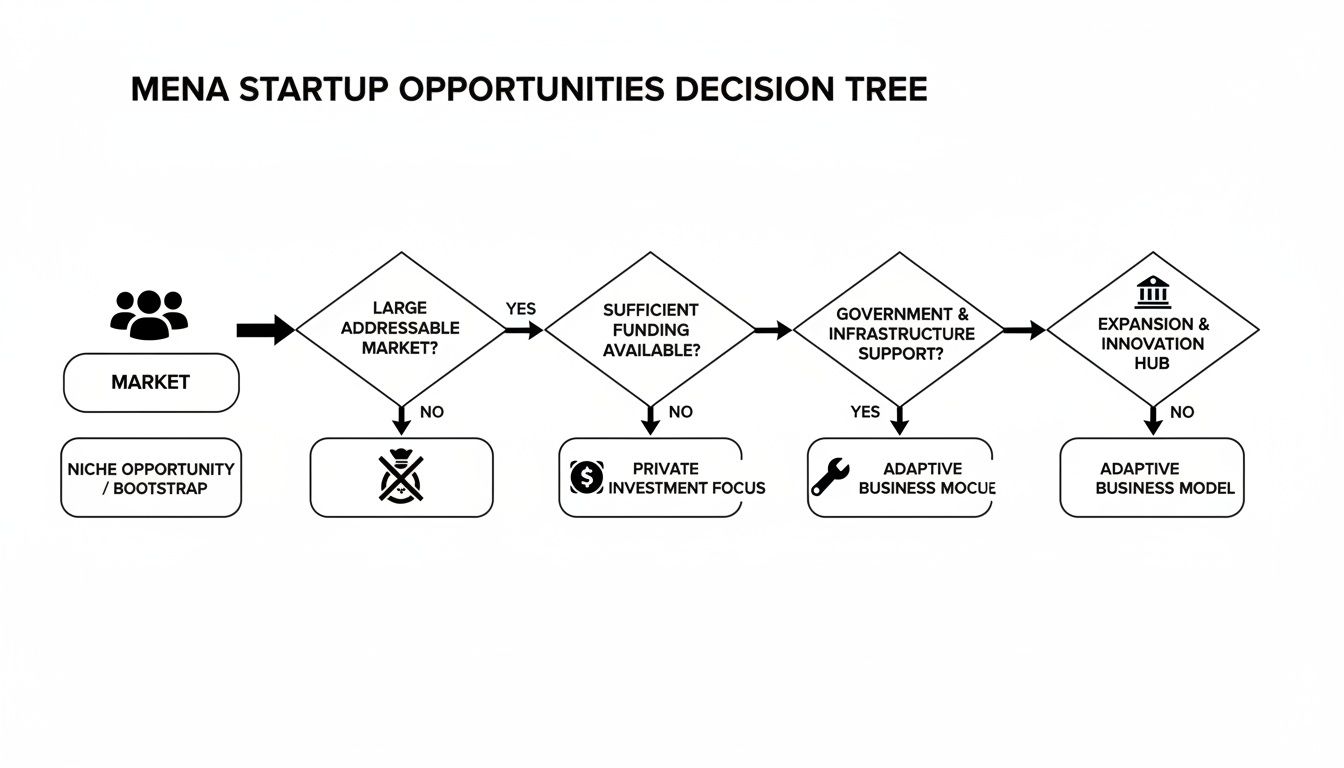

This decision tree helps visualize the core factors—market access, funding, and government support—that should steer your choice.

As the graphic shows, your path depends on what you prioritize: a massive local market (Riyadh), a global launchpad (Dubai), or deep-tech support (Abu Dhabi).

While the "big three" get most of the attention, other cities are building ecosystems with unique strengths:

Looking even wider, you might consider hubs like Turkey. It's crucial to understand the different legal and operational landscapes. A quick look at a guide comparing Turkey vs. UAE company formation shows just how different the frameworks can be. The right choice comes down to balancing what your startup needs today with where you want it to go tomorrow.

Securing capital is a defining journey for any startup, and the Middle East has its own distinct rhythm. To succeed, you need to understand this flow—from the first angel checks to institutional venture capital—so you can time your raise, set realistic targets, and get in front of the right investors.

The ecosystem is flush with capital. A wave of local and international funds are actively deploying, driven by strong economic fundamentals and a government push for innovation. But this doesn't mean fundraising is easy. It means the competition is sophisticated, and investors expect you to know the rules of the game.

Investor interest isn't spread evenly. Right now, a few specific sectors are acting like magnets for funding, thanks to powerful market demand and their alignment with the region's strategic goals.

Three areas consistently draw the most attention from VCs:

Key Insight: Investors here are increasingly backing startups that solve a tangible, localized problem. A generic business model without a clear MENA-specific angle will almost always struggle to get traction.

Knowing what to ask for is as important as knowing who to ask. Valuations and check sizes in MENA have matured, and founders need to approach fundraising with realistic, data-backed expectations.

Here’s a simple framework of what to expect:

This growth is powered by serious institutional support. The UAE's ecosystem has expanded rapidly; Dubai alone was home to over 3,500 active startups by 2023 with a combined valuation of more than $28 billion. On top of that, the Golden Visa program now grants 10-year residency to entrepreneurs, tackling the talent retention challenge head-on.

In the MENA funding landscape, relationships are currency. Unlike more transactional ecosystems, cold outreach to investors here is notoriously ineffective. The path to a meeting almost always runs through a warm introduction from a trusted mutual connection. For a deeper look at this dynamic, check out our guide to fundraising for startups.

An intro from another founder, a lawyer, or a community leader vouches for your credibility before you even walk in the door.

Next Action: Start Building Your Network Now

Don’t wait until you need money to start building relationships. Map out your network and identify who can open doors for you.

For any founder, building the right team is everything. In the Middle East, you're stepping into a unique arena—one filled with immense opportunity and equally intense competition. The right people are your single biggest advantage, but finding them means getting smart about the MENA talent market.

Your success will hinge on your ability to attract, hire, and retain skilled professionals in a region where global corporations and well-funded scale-ups are all chasing the same top-tier talent. It’s not just about salary. It's about crafting a value proposition that connects with both local and international candidates.

Sourcing great people requires a multi-channel approach. Just posting on a generic job board won’t get you far. The founders who win are proactive, creative, and relentless.

Consider these channels:

The talent pool is deepening. The UAE and Saudi Arabia are attracting skilled professionals, especially in STEM and AI, at a rapid pace. Government-backed initiatives like 'Create Apps in Dubai' are training thousands of local developers, creating a massive opportunity.

Hiring in MENA is about more than matching skills to a job description. You must navigate local labor laws, visa processes, and cultural expectations. Getting this wrong leads to costly delays and losing great candidates.

The visa process is a critical piece of the puzzle. While it can seem daunting, regional governments have simplified it for startups.

The Golden Visa program in the UAE is a game-changer. It offers 10-year residency to entrepreneurs, investors, and exceptional talent, giving key team members stability and making your startup a far more attractive long-term bet for international hires.

Beyond visas, you need a solid grasp of regional compensation benchmarks. Salaries can swing wildly between Dubai, Riyadh, and Cairo. Use local salary surveys and network with other founders to ensure your offers are competitive without torching your burn rate. For more on this, check out our guide on how UAE founders built strong teams.

As an early-stage startup, you probably can't outbid large corporations on salary. So, don't. Compete on a different playing field: culture, ownership, and mission.

Focus on what makes working at a startup unique and exciting:

Next Action: Define your employee value proposition. Grab your team and answer these three questions:

Answering these gives you the core story you need to attract the best people.

You have your team and funding. Now for the hard part: launching. A brilliant idea is just a starting point. Your success in the Middle East hinges on a rock-solid go-to-market (GTM) plan built for the region’s unique legal and customer quirks.

This starts with your legal structure. It's a foundational choice that dictates who you can hire, who you can sell to, and how you can raise money.

This is the first major fork in the road. The right answer depends on your business model and, most importantly, who you plan to sell to.

Next Action: Ask your team one simple question: "Who are our primary customers and where are they?" If the answer is "consumers and businesses inside the UAE," you almost certainly need a Mainland license. If it's "regional or global clients," a Free Zone offers more freedom and control.

Once your legal setup is locked in, it’s all about acquiring customers. A generic GTM strategy copied from a Silicon Valley blog will fail here. The MENA region isn't a single market. How people shop, which social media they use, and which marketing channels they trust vary dramatically from country to country.

Localization is more than just translating your app into Arabic. It’s about getting cultural nuances right, offering the payment methods people actually use (cash-on-delivery is still dominant in many areas), and understanding that for many, WhatsApp is the primary channel for business communication. For a solid starting framework, review a guide for building a winning B2B Go-To-Market Strategy.

Spend your marketing budget where your audience actually lives online. Global platforms have their place, but ignoring local channels is a mistake.

Here are a few channels that consistently deliver for startups in the Middle East:

Remember, your first GTM strategy is a set of educated guesses. The real goal is to get out there, test, and adapt quickly based on real customer feedback.

Learning from your own mistakes is good. Learning from someone else’s is faster and cheaper. While the Middle East is packed with opportunity, it has unique traps that can catch even the sharpest founders.

Spotting these roadblocks early lets you navigate the terrain with more confidence. Let's cover the most common stumbles and how to sidestep them.

One of the biggest blunders is treating the MENA region as a single market. It’s not. A strategy that works in Dubai can bomb in Riyadh. This goes beyond just translating your app.

True localization means digging into cultural nuances, understanding local payment preferences (cash-on-delivery is still huge), and navigating different regulations. A copy-paste approach is a fast way to burn through your seed round.

Setting up in a global hub like Dubai or Riyadh is expensive. Founders consistently underestimate the true cost of living and doing business. High salaries, office rents, and visa fees will drain your bank account faster than you think.

Poor cash flow management kills startups everywhere, but the pressure is intense in these high-cost cities.

Next Action: Before registering your company, build a detailed 18-month financial model. Be brutally honest with your revenue projections and get real, local quotes for salaries, rent, and admin fees. This forces a tough conversation about your burn rate from day one.

In the Middle East, business moves at the speed of trust. Relationships are everything. Unlike in ecosystems where a clever cold email might work, here it’s all about warm introductions. Founders who try to operate in a silo will struggle to get anywhere.

Without a strong local network, you’re cut off from investor meetings, top talent, strategic partnerships, and priceless market intel.

How to Start Building Your Network From Day One:

Avoiding these mistakes isn’t about knowing everything. It’s about asking the right questions, staying close to your customers, being smart with your money, and building the relationships that will carry you through the journey.

When diving into the MENA startup scene, the same questions pop up again and again. Getting straight answers quickly lets you spend less time guessing and more time building.

While many focus on funding, the real make-or-break challenge is often market fragmentation. You can't just copy-paste a strategy from the UAE and expect it to work in Saudi Arabia or Egypt.

Each country has its own regulations, consumer behaviors, and cultural nuances. Success means treating each market as a unique puzzle. The other big hurdle is talent; the competition for proven tech professionals is fierce. The best way to overcome both is by building a solid local network—it's your key to unlocking both top-tier talent and critical market insights.

This can vary, but here's a realistic ballpark. A basic Free Zone license will set you back AED 15,000 to AED 25,000 annually.

But that’s just the start. You also have to factor in visas (around AED 5,000–8,000 per person), office space, and operating cash. For a lean tech startup, a conservative first-year budget is AED 200,000 to AED 400,000. This should cover setup costs and give a small team at least six months of runway.

Don't just budget for the license fee. Your true "cost to launch" is the total capital needed to survive the first six to nine months, including salaries, marketing, and unexpected expenses. Underestimating this is a common—and fatal—early-stage mistake.

Investor money is flowing into key areas fueling the region's growth. Knowing where the smart money is going helps you position your Middle East startup to catch that wave.

Here's where the action is:

HealthTech and EdTech are also on the rise, thanks to a young, fast-growing population. If you’re solving a real, local problem in one of these spaces, investors will want to talk.

Building a startup is tough, but you don't have to do it alone. Founder Connects is a private community designed for MENA founders who want curated peer groups, meaningful introductions, and the practical support needed to grow. Stop navigating the journey in isolation and start building with a trusted circle. Learn more and apply to join at https://www.founderconnects.com.