What exactly is a start up company? It's a critical question for any founder in the UAE or MENA, because the answer shapes your strategy, funding, and goals.

Many people use "new business" and "start up" interchangeably. A new coffee shop and a new fintech platform are both new ventures, but they are fundamentally different. A traditional business follows a proven map to generate predictable profit. A start up is a high-speed experiment designed for one thing: rapid, massive growth. It embraces immense risk for an equally immense reward.

Getting this distinction right from day one is essential. It defines whether you're building a local business or a venture that could dominate a regional market.

A true start up isn't just a cool idea. It's defined by three core traits. If you see these in your venture, you're on the start up path.

Next Action: Ask your founding team this question: "Is our business built to achieve 10x growth in 5 years, or is it designed for predictable, local profit?" Your answer immediately clarifies whether you're building a start up or a traditional small business.

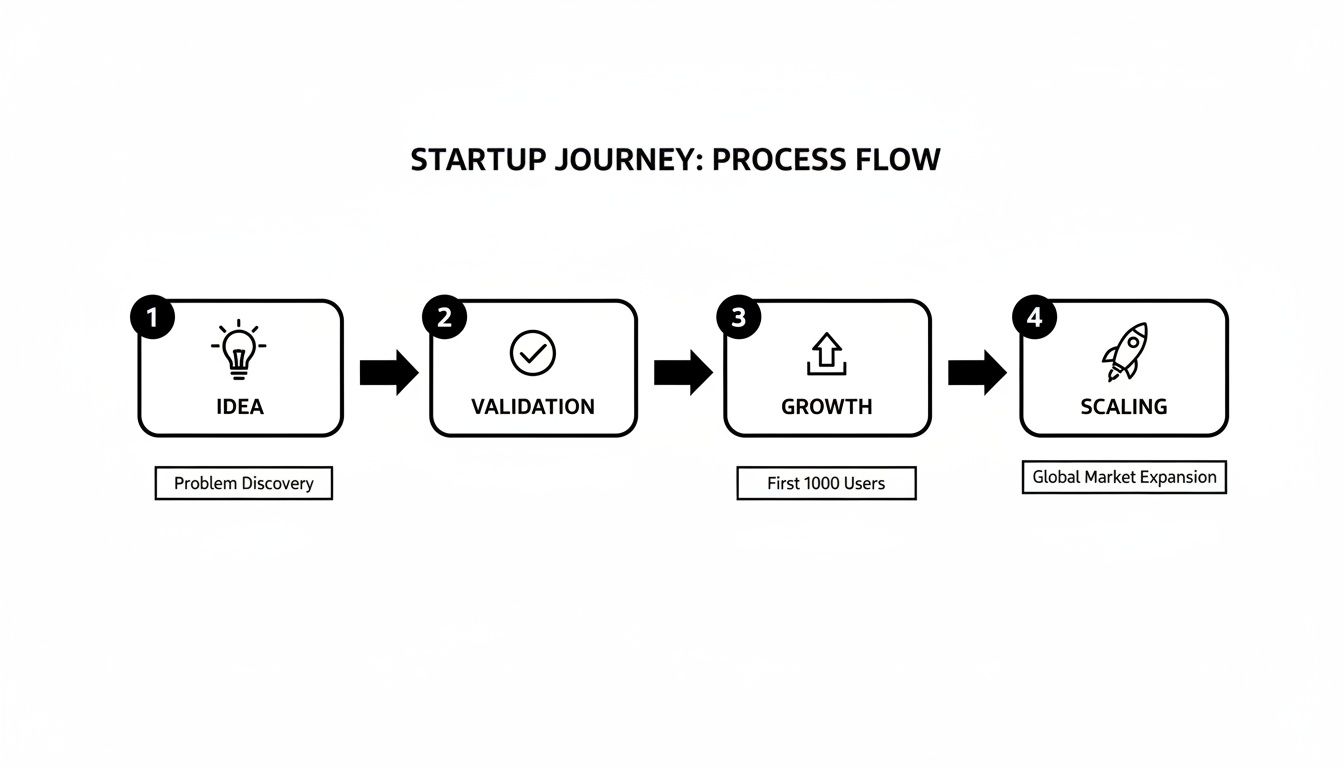

Every start up, whether a fintech in DIFC or a SaaS platform in Riyadh, follows a similar path. Understanding these stages gives you a clear roadmap, telling you what to focus on now and what can wait. Trying to scale before validating your idea is a recipe for disaster.

This path isn’t about ticking boxes; it's about evolving from a concept into a scalable business.

This is ground zero. Your start up is just a bundle of assumptions wrapped around a problem. Your only job is to become obsessed with that problem, not your solution.

Next Action: Identify 10 people in your target market this week. Get on a call or grab a coffee. Ask: "Tell me about the last time you struggled with [the problem area]." Do not pitch your idea. Just listen and take notes.

You've found a problem worth solving. Now, will anyone actually use and pay for your solution?

This is where you build a Minimum Viable Product (MVP)—the most basic version of your product that solves the core problem. It might be clunky, but it must work. Knowing what to build before you launch is critical.

With a working MVP and initial users, the game changes. The focus shifts to finding a repeatable way to grow.

You're now hunting for product-market fit—that magical moment when your start up starts pulling in customers, almost on its own.

You've found product-market fit. Now it's time to pour fuel on the fire.

This stage is about executing your proven model bigger, faster, and more efficiently. You’ll be hiring key people, optimising processes, and expanding into new markets across the MENA region.

For any founder in the UAE and the wider MENA region, funding is a constant conversation. The good news: the regional investment scene is booming. Mature ecosystems in Dubai and Abu Dhabi, along with a surging Saudi market, have become magnets for serious investor interest. According to MAGNiTT, MENA startups raised $2 billion in 2023, showcasing the depth of capital available.

However, more capital means more competition. Understanding your options is the first step to securing the right funding.

Raising capital is a strategic journey. For MENA founders, it typically involves these sources at different stages.

The real challenge isn't just finding investors; it's getting in front of the right ones. Cold emails rarely work. A warm introduction from a respected source is a game-changer.

Next Action: Make a list of five people in your network who have either raised money or are connected to investors. Ask for a 15-minute chat to share what you’re building and ask for one piece of advice. Build the relationship before you ask for an introduction.

In a community like Founder Connects, members share real-time intel on which VCs are active and who can make crucial warm intros. Learning from a founder who just closed their round can save you months of trial and error. Explore more strategies in our guide to fundraising for startups.

Choosing the right legal structure for your start up company in the UAE is a critical early decision. It impacts ownership, taxes, operations, and your ability to raise capital. Get it wrong, and you could face unnecessary costs and operational headaches.

For most tech founders, the choice is between setting up on the Mainland or in a Free Zone.

Next Action: Answer this one question with your team: "Where are our primary customers?" If you're building a SaaS platform for a global or regional audience, a Free Zone is usually the most efficient choice. If you need a physical presence in a Dubai mall, Mainland is your only option.

While specifics vary, the process generally follows these steps.

The entire process can take a few weeks to a couple of months. For a detailed breakdown, see our guide on how to start a business in Dubai.

Building a start up is packed with obstacles. In the fast-paced UAE/MENA ecosystem, three challenges consistently surface: founder isolation, decision fatigue, and the battle for talent. Navigating them requires building support systems before you need them.

You can be surrounded by your team, investors, and customers, yet feel completely alone. The weight of every decision rests on you—a burden few can understand. This isolation leads to burnout and poor judgment.

Actionable Solution: Form a Personal Board of Directors.

This isn't a legal board. It's a trusted group of 3-4 other founders at a similar stage. Meet monthly to discuss challenges and progress in a confidential space. This peer group provides objective advice from people living the same reality.

Founders make hundreds of decisions daily. This mental load drains your ability to make sharp choices. You need a simple framework to conserve energy for what matters.

By categorizing decisions this way, you save your best thinking for the choices that truly move the needle.

The UAE market is competitive. You can't outbid large corporations on salary, so you must compete on culture, mission, and ownership. A generic job description attracts generic candidates.

Next Action: Write a Mission-Driven Job Description.

Start your next job post with a section titled "Why This Role Matters." Explain how this position directly helps solve the problem your company is tackling. Emphasize the impact they will have. This approach filters for mission-aligned people who are driven by more than a pay cheque.

Managing human resources is a significant challenge. To navigate this, exploring the Best HR Solutions for Startups offers valuable guidance.

Knowing the theory of building a start up company is one thing. Executing is another. The journey from idea to scaling business is isolating, but it doesn’t have to be. For founders in the UAE and MENA, the right community is a core business strategy. It acts as an accelerator, helping you sidestep pitfalls and seize opportunities faster.

Most networking events are transactional. A curated community like Founder Connects is built differently. The focus is on solving real challenges through structured support.

This deliberate approach leads to tangible progress and smarter decisions. We’ve written more about why founders benefit from structured peer groups.

The UAE’s startup ecosystem is a powerhouse. In 2023, Dubai alone hosted over 3,500 active startups with a combined valuation smashing $28 billion, fueled by smart government initiatives and over $2 billion in funding. This momentum creates huge opportunities and intense competition.

A trusted community becomes an unfair advantage, fast-tracking the critical connections you need to grow.

Next Action: Map your current support system. List the people you turn to for tactical advice, strategic feedback, and moral support. Identify the gaps. Where could a peer who has "been there, done that" just six months ago make the biggest difference for you right now?

Here are quick, practical answers to the most common questions we hear from founders in the trenches.

It's extremely difficult in this region. VCs invest in teams, not just ideas. They look for a founding team with complementary skills (e.g., tech, product, commercial). A co-founder demonstrates you can sell a vision and adds resilience. If you're solo, your top priority should be finding the right co-founder before approaching VCs.

Stop. Do not build anything. Your first step is customer discovery. Find at least 20 people in your target market and talk to them.

This feedback is more valuable than any business plan and prevents you from building a product nobody wants.

The biggest mistake is defaulting to a 50/50 split without discussion. Equity should be a thoughtful conversation based on tangible factors:

Use a co-founder equity calculator to structure the conversation. Crucially, ensure all shares are subject to a vesting schedule—typically four years with a one-year cliff. This protects the company by ensuring equity is earned over time.

The founder journey is a marathon of questions. At Founder Connects, our curated peer groups offer a confidential space to get unfiltered answers from other founders who've been exactly where you are. Learn more about how our community helps you move faster.